Last week’s ThinkBIM conference focused on the transition of data from construction to facilities management. FM is getting more involved with BIM from the earliest stages of a project, and will collaborate more frequently during project delivery.

![]() The latest ThinkBIM half-day conference (on 6 July at Squire Patton Boggs’ new offices in Leeds, and sponsored by Trimble and construction collaboration vendor GroupBC, formerly Business Collaborator) looked at the use of building information modelling by those working in facilities management, operations and maintenance for owner-operator organisations, and yet – on a show of hands – only a small handful of attendees were actually employed in FM. The day therefore repeatedly returned to what government and industry needs to do to get more FM professionals engaged with BIM.

The latest ThinkBIM half-day conference (on 6 July at Squire Patton Boggs’ new offices in Leeds, and sponsored by Trimble and construction collaboration vendor GroupBC, formerly Business Collaborator) looked at the use of building information modelling by those working in facilities management, operations and maintenance for owner-operator organisations, and yet – on a show of hands – only a small handful of attendees were actually employed in FM. The day therefore repeatedly returned to what government and industry needs to do to get more FM professionals engaged with BIM.

The government push on BIM for FM

![ThinkBIM July 2016]() The business case for BIM has been well made by the UK Government’s BIM Task Group since 2011. Keynote speaker Deborah Rowland (currently director of FM at the Ministry of Justice) has been at the forefront in pushing the BIM for FM message in the public sector. Citing Government Soft Landings (GSL), she underlined how asset management is fundamental to BIM-enabled project delivery, with client facilities managers involved from a project’s inception in helping to define the employer’s information requirements (EIR) and asset information management (AIM) needs.

The business case for BIM has been well made by the UK Government’s BIM Task Group since 2011. Keynote speaker Deborah Rowland (currently director of FM at the Ministry of Justice) has been at the forefront in pushing the BIM for FM message in the public sector. Citing Government Soft Landings (GSL), she underlined how asset management is fundamental to BIM-enabled project delivery, with client facilities managers involved from a project’s inception in helping to define the employer’s information requirements (EIR) and asset information management (AIM) needs.

PAS 1192-3 covering information management in the operational phase was published in March 2014, and since then advice, standards and protocols covering FM inputs to BIM and beyond have expanded. Deborah highlighted recent useful additions, notably a RICS-developed NRM3 dLCC (digital lifeycle cost) toolkit which aligns BIM with SFG20 maintenance information needs (more about SFG20 here). The MoJ’s BIM2AIM group also recently launched a suite of documents providing clear and concise instruction and guidance on how to define, procure and deliver Level 2 BIM projects (read BIM+ news).

The MoJ’s strategy envisages such tools providing, among other things, much-needed transparency and evidence of value for money to taxpayers, while providing the MoJ with key information to make strategic decisions on its asset portfolio, to innovate, and to continually improve. Surely, many other client organisations will want to reap similar benefits?

“Keeping the BIM live”

![ThinkBIM July 2016]() The second keynote came from CAFM software vendor FSI’s Jacqueline Walpole. She recalled how many FMs were once a paper-based afterthought. Typically, for the client or owner-operator, the completion of a built asset was followed, nine months later, by the handover of a large paper-based archive of information, much of it in paper-based form, some of it already out-of-date (it was for this reason, I remember, that BIW Technologies – later Conject, now Aconex – was one of the first collaboration vendors to digitise the production of the Health and Safety File, work initially undertaken in partnership with retailer Sainsbury’s in 2002 – post).

The second keynote came from CAFM software vendor FSI’s Jacqueline Walpole. She recalled how many FMs were once a paper-based afterthought. Typically, for the client or owner-operator, the completion of a built asset was followed, nine months later, by the handover of a large paper-based archive of information, much of it in paper-based form, some of it already out-of-date (it was for this reason, I remember, that BIW Technologies – later Conject, now Aconex – was one of the first collaboration vendors to digitise the production of the Health and Safety File, work initially undertaken in partnership with retailer Sainsbury’s in 2002 – post).

Computer-aided FM (CAFM), therefore, often tended to start from scratch. Digitising design, construction, commissioning and handover processes, she said, opens up the prospect of a digital flow of information into FM (“keeping the BIM live”), achieving operational readiness almost instantly, and Jacqueline highlighted the publication of a new BIFM guide (available here) to achieving such readiness, which includes an EIR template.

The two short keynotes, therefore, promoted readily available toolkits, guides and templates showing how BIM can be applied to support FM, and, in so doing, to enhance the roles of facilities managers. I would expect collaboration/’common data environment’ (CDE) vendors to be looking to incorporate elements of these templates into their workflows and reporting tools to support clients’ facilities managers.

Data for operation and maintenance

Two of the afternoon’s roundtable workshop sessions underlined the potential value of data to help managers improve the performance of their assets and to connect their built asset’s data with valuable data held in other systems, but recurring themes about people and silo cultures also surfaced.

Jacqueline Walpole chaired one of the roundtables. She got delegates to consider, first, what data might be needed to support asset operations (with a nod to ‘lean’ thinking: “if in doubt, ask the caretaker – what are their ‘must haves’?”), and how some data schemas manage simple issues such as floor-numbering.

Second, we talked about how in-service performance data might be used to support asset management. Applying analogies including cars and jet engines, we talking about creating and maintaining a built asset’s “service history,” and using the data generated by different building systems’ sensors to improve reliability and energy efficiency. Just as Rolls-Royce routinely collates huge volumes of data from every engine and flight as a basis for meeting its customers’ service level agreements, so facilities managers could collate and analyse built environment data (energy use, temperature, humidity, heating, lighting, equipment use, etc, over time) to support post-occupancy evaluation, optimise lifecycle cost efficiency, and – for ‘repeat clients’ – provide data to help them collaborate with design teams to improve the planning, design, construction and operation of future built assets.

Linked data for better decision-making

GroupBC’s Steve Crompton led a roundtable pondering trust issues and other reasons why construction project teams have tended to re-key rather than re-use data. Conflicting standards, industry inertia and resistance to major people and process-related changes quickly cropped up. Old attitudes of ‘knowledge is power’ need to be overcome, as does distrust of ‘other people’s data’ (“We don’t trust digital data yet, because we haven’t moved on from distrusting paper information, or stuff off the web”). This workshop also highlighted some of the messages from June’s ThinkBIM ‘twilight’ event (read my post: Open Data, BIM and the semantic web) – semantic web technologies can help connect data about built assets to other data about the environment and about social aspects of the areas around those built assets. However, security, commercial confidentiality and personal privacy concerns all need to be addressed in selecting what data might be shared and used.

![ThinkBIM July 2016]() Finally, delegates heard a ‘RetroBIM’ case study from BIM Academy’s Graham Kelly, relating to the compilation of data to support improvement works undertaken at Sydney Opera House in Australia. That a UK-based firm led this project is another indication of how UK BIM experience is prized by clients worldwide, and there is clearly potential for UK FM businesses to similarly become world leaders in applying BIM to FM – though Graham was cautious about some software businesses: “BIM software companies have raised uninformed expectations,” he said.

Finally, delegates heard a ‘RetroBIM’ case study from BIM Academy’s Graham Kelly, relating to the compilation of data to support improvement works undertaken at Sydney Opera House in Australia. That a UK-based firm led this project is another indication of how UK BIM experience is prized by clients worldwide, and there is clearly potential for UK FM businesses to similarly become world leaders in applying BIM to FM – though Graham was cautious about some software businesses: “BIM software companies have raised uninformed expectations,” he said.

The conference talked about the return on investment (ROI), but also highlighted it is not only a technological change. ‘Silo cultures’ and ‘change management’ were two of the key risks on Graham’s project. The same people and process themes were voiced in the workshops, and they apply equally to the wider adoption of BIM – and not just by the FM community.

[Disclosures: This is an edited version of a post first published on the ThinkBIM blog, delivered as part of consultancy support for Leeds Beckett University. Separately, I have also delivered consultancy services to GroupBC.]

After the 17 March 2016 announcement of Conject‘s acquisition by Aconex, the UK business’s managing director Steve Cooper sought to reassure the company’s SaaS construction collaboration customers and users about the business’s future. In an email (18 March), he says:

After the 17 March 2016 announcement of Conject‘s acquisition by Aconex, the UK business’s managing director Steve Cooper sought to reassure the company’s SaaS construction collaboration customers and users about the business’s future. In an email (18 March), he says:The merging of Conject with Aconex creates a significant and positive development for our customers and users, wherever in the world they are located. Together with Aconex, we become a truly global provider:

Is it a game-changer? “It’s huge and has a very exciting outcome, but it was only a matter of time. When Aconex raised their last round of funding they were expected to acquire. I spoke with Leigh about this at the time – I’m just surprised it took so long.”

“As one of the leading CDEs available, GroupBC is delighted to see that our once niche industry has matured to such an extent that acquisitions of this scale are now happening.

“It is a privilege to witness the continued growth and evolution within the sector we helped to create, and we await with interest the outcome of this union and wish both companies well.”“The deal set off some strong feelings. I founded BIW Technologies and was CEO of Conject for three years of intense change. It was a memorable experience and I retain many good friends among its colleagues and customers.

The merging of Conject with Aconex creates a significant and positive development for our customers and users, wherever in the world they are located. Together with Aconex, we become a truly global provider:

The merging of Conject with Aconex creates a significant and positive development for our customers and users, wherever in the world they are located. Together with Aconex, we become a truly global provider: Is it a game-changer? “It’s huge and has a very exciting outcome, but it was only a matter of time. When Aconex raised their last round of funding they were expected to acquire. I spoke with Leigh about this at the time – I’m just surprised it took so long.”

Is it a game-changer? “It’s huge and has a very exciting outcome, but it was only a matter of time. When Aconex raised their last round of funding they were expected to acquire. I spoke with Leigh about this at the time – I’m just surprised it took so long.” “As one of the leading CDEs available, GroupBC is delighted to see that our once niche industry has matured to such an extent that acquisitions of this scale are now happening.

“As one of the leading CDEs available, GroupBC is delighted to see that our once niche industry has matured to such an extent that acquisitions of this scale are now happening. “The deal set off some strong feelings. I founded BIW Technologies and was CEO of Conject for three years of intense change. It was a memorable experience and I retain many good friends among its colleagues and customers.

“The deal set off some strong feelings. I founded BIW Technologies and was CEO of Conject for three years of intense change. It was a memorable experience and I retain many good friends among its colleagues and customers. The compilation of operation and maintenance information for handover to the owner/operator of a built asset used to involve retrospective collation of large volumes of documentation, with much of the information duplicated across different sections, and often more than copy of the whole O&M manual needing to be delivered.

The compilation of operation and maintenance information for handover to the owner/operator of a built asset used to involve retrospective collation of large volumes of documentation, with much of the information duplicated across different sections, and often more than copy of the whole O&M manual needing to be delivered. In short, this requirement is already being targeted by several SaaS technology vendors, but that doesn’t mean there isn’t room for others. I was recently contacted by Brenton Wiberg, a partner in California, US-based

In short, this requirement is already being targeted by several SaaS technology vendors, but that doesn’t mean there isn’t room for others. I was recently contacted by Brenton Wiberg, a partner in California, US-based

With a few honourable exceptions (some mentioned in the

With a few honourable exceptions (some mentioned in the

Manolis, who started out as a chemical engineer working in the UK (he studied at Manchester University and was CEO of Northwich-based Linnhoff March in my home county of Cheshire for a time), was recruited to Viewpoint from

Manolis, who started out as a chemical engineer working in the UK (he studied at Manchester University and was CEO of Northwich-based Linnhoff March in my home county of Cheshire for a time), was recruited to Viewpoint from  “Looking at 1,840 deals reported by Construction Enquirer, worth around £25 billion, we are working with 95% of the top 20 contractors, and 50% of these solely use ViewPoint For Projects for all their projects. Looking at our Field View customers, 20% of these are on enterprise deals, with 20% using both products.

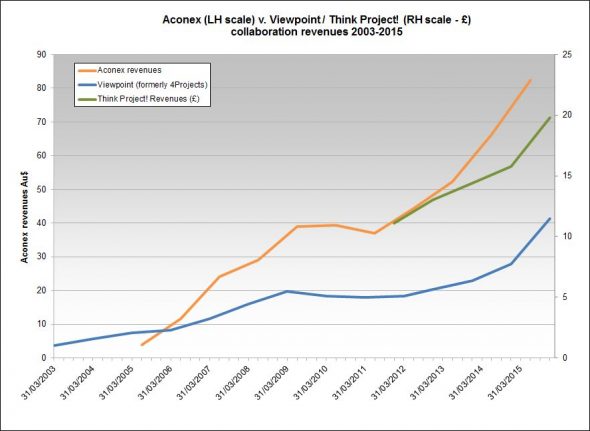

“Looking at 1,840 deals reported by Construction Enquirer, worth around £25 billion, we are working with 95% of the top 20 contractors, and 50% of these solely use ViewPoint For Projects for all their projects. Looking at our Field View customers, 20% of these are on enterprise deals, with 20% using both products. Revenues for the year to 30 June 2015 were up 9% from £2.74m to just over £3m, but

Revenues for the year to 30 June 2015 were up 9% from £2.74m to just over £3m, but  Almost exactly three months after Aconex acquired the Germany-based Conject business (

Almost exactly three months after Aconex acquired the Germany-based Conject business ( “The Austrian market is an important core market for think project!. The presence of international and regionally influential construction contractors, globally active engineering companies and particularly public infrastructure clients such as ASFINAG (Austrian motorway operator) and ÖBB (Austrian Railways) make Austria a market with exceptional development potential for think project!.”

“The Austrian market is an important core market for think project!. The presence of international and regionally influential construction contractors, globally active engineering companies and particularly public infrastructure clients such as ASFINAG (Austrian motorway operator) and ÖBB (Austrian Railways) make Austria a market with exceptional development potential for think project!.” Falling into the second category is TIM:

Falling into the second category is TIM:  The latest

The latest

Secure Cloudlink provides anonymised authentication to SaaS, cloud or on-premise applications without storing, replicating or transmitting passwords anywhere outside of the directory services. Using a patented token security system that operates without the use of passwords,

Secure Cloudlink provides anonymised authentication to SaaS, cloud or on-premise applications without storing, replicating or transmitting passwords anywhere outside of the directory services. Using a patented token security system that operates without the use of passwords,

“Our financial results for FY16 demonstrated strong fundamental performance, driven by the consistent execution of our growth strategy. We continued to expand our global user network by winning new business from both new and existing customers, and to move existing customers from project engagements to enterprise agreements. We completed three acquisitions to further increase the value that we deliver to customers and consolidate our leading market position worldwide. With these acquisitions as well as organic sales momentum, we continued to scale the business for significant growth in profitability. The US$10 trillion construction industry is going digital, and we are at the centre of this digital transformation, connecting people and data to build the world’s infrastructure.”

“Our financial results for FY16 demonstrated strong fundamental performance, driven by the consistent execution of our growth strategy. We continued to expand our global user network by winning new business from both new and existing customers, and to move existing customers from project engagements to enterprise agreements. We completed three acquisitions to further increase the value that we deliver to customers and consolidate our leading market position worldwide. With these acquisitions as well as organic sales momentum, we continued to scale the business for significant growth in profitability. The US$10 trillion construction industry is going digital, and we are at the centre of this digital transformation, connecting people and data to build the world’s infrastructure.” “The integration is tracking well. Staff and customers are engaged, and our key operational systems, processes and policies are aligned. The Conject and Aconex cultures are highly complementary, and we look forward to what we can achieve as one company.”

“The integration is tracking well. Staff and customers are engaged, and our key operational systems, processes and policies are aligned. The Conject and Aconex cultures are highly complementary, and we look forward to what we can achieve as one company.” As previously described (

As previously described ( Also based in Germany, in Stuttgart, is RIB Software. In 2015 (according to its annual report,

Also based in Germany, in Stuttgart, is RIB Software. In 2015 (according to its annual report,

Createmaster also has links with Melbourne, Australia-based QA Software, provider of the Teambinder collaboration application (

Createmaster also has links with Melbourne, Australia-based QA Software, provider of the Teambinder collaboration application (

According to the Budget4cast website, the application allows users to:

According to the Budget4cast website, the application allows users to: 2015 was a bumper year for

2015 was a bumper year for

The integration has been progressing very well at a customer and people level. We have retained all customers and key staff and have very good cultural alignment between the two businesses. We are also making solid progress on operational integration, moving toward one single operating platform and set of standards for the company globally.

The integration has been progressing very well at a customer and people level. We have retained all customers and key staff and have very good cultural alignment between the two businesses. We are also making solid progress on operational integration, moving toward one single operating platform and set of standards for the company globally.

In May 2015, PAS1192-5 – “Specification for security-minded building information modelling, digital built environments and smart asset management” – became the latest addition to the suite of UK documents focused on building information modelling (BIM). Other documents – notably PAS1192-2 – cover the adoption and use of a ‘common data environment’ (CDE), and this has been a key area for construction collaboration technology vendors, but they will also need to help their customers and project teams address some of their security requirements.

In May 2015, PAS1192-5 – “Specification for security-minded building information modelling, digital built environments and smart asset management” – became the latest addition to the suite of UK documents focused on building information modelling (BIM). Other documents – notably PAS1192-2 – cover the adoption and use of a ‘common data environment’ (CDE), and this has been a key area for construction collaboration technology vendors, but they will also need to help their customers and project teams address some of their security requirements.