In January 2017, TA Associates, a leading global growth private equity firm, announced it has completed an investment in Munich, Germany-based think project!, a provider of cross-enterprise collaboration and information management software to the construction and engineering industries. Financial terms of the transaction were (unfortunately) not disclosed.

In January 2017, TA Associates, a leading global growth private equity firm, announced it has completed an investment in Munich, Germany-based think project!, a provider of cross-enterprise collaboration and information management software to the construction and engineering industries. Financial terms of the transaction were (unfortunately) not disclosed.

J. Morgan Seigler, a managing director at TA Associates (who will join the think project! Board of Directors) said:

“We believe think project! is an exceptional company that has established itself as a leading provider in a relatively unique, yet rapidly growing sector. Under the direction of Thomas Bachmaier and his talented management team, think project! has enjoyed consistent growth in its core German market and internationally. We are delighted to partner with a company with such a strong foundation and welcome the opportunity to support the continued evolution of think project!.”

think project! CEO Thomas Backmaier said:

“Since our founding, think project! has continuously strived to serve our customers and to help them achieve their goals by catering to their individual needs. We would like to thank co-Founder and former investor, WALTER Beteiligungen und Immobilien AG, for their historical support, and are confident that our new partnership with TA Associates will serve to strengthen our brand and further our growth. We are thrilled to begin working with such an experienced and well-respected firm, and look forward to benefiting from TA’s valuable insight and support.”

Founded in 2000, think project! offers a SaaS, multi-tenant platform used by more than 100,000 users across over 8,000 projects in 40 countries. think project! delivers a readily available and shapeable common data environment (CDE) for construction and engineering projects. Since 2015, its solutions have been building information modeling (BIM)-enabled, offering application program interfaces (APIs) for close integration with other business applications and can be accessed via multiple touchpoints and devices. think project! currently supports asset owners and general contractors across more than 20 sectors, including the energy and automotive industries, infrastructure and government projects.

European battleground

The company now has approximately 200 employees across its Munich headquarters, its R&D centers in Berlin and Szczecin, and, as Thomas told me last October, has been strengthening across Europe – in Spain (it established a joint venture with Madrid-based ProjectCenter in September 2016), Poland, Austria (it acquired 70% of Austrian sales partner i-pm in June 2016), the Netherlands, France (it acquired 60% of Lascom AEC, France’s market leader in product lifecycle management (PLM) and cross-enterprise collaboration software in September 2015), and in Germany (it acquired domestic competitor Conetics in October 2016).

The think project! news release repeats figures also used by global leader, Melbourne, Australia-based Aconex (who acquired think project’s Anglo-German rival Conject in March 2016) saying the global addressable market for construction collaboration software is estimated by Frost & Sullivan at $5.6 billion with a current penetration of less than 10%, implying a present market size of roughly $500 million. According to research from PwC, the global infrastructure construction market is expected to grow 6.5% annually to $9 trillion by 2025.

Naveen A. Wadhera, a managing director at TA Associates, adds:

“With our focus on investing in profitable, growing businesses, construction software is a highly attractive sector for TA. Given its well-established presence in Germany and accelerating growth in Spain, Poland, the Benelux countries and elsewhere, we believe think project! is well positioned as a market leader in continental Europe. We look forward to working with the think project! management team, building on their success to date and furthering the company’s expansion through organic and inorganic growth.”

“Since our founding, think project! has continuously strived to serve our customers and to help them achieve their goals by catering to their individual needs. We would like to thank co-Founder and former investor, WALTER Beteiligungen und Immobilien AG, for their historical support, and are confident that our new partnership with TA Associates will serve to strengthen our brand and further our growth. We are thrilled to begin working with such an experienced and well-respected firm, and look forward to benefiting from TA’s valuable insight and support.”

“Since our founding, think project! has continuously strived to serve our customers and to help them achieve their goals by catering to their individual needs. We would like to thank co-Founder and former investor, WALTER Beteiligungen und Immobilien AG, for their historical support, and are confident that our new partnership with TA Associates will serve to strengthen our brand and further our growth. We are thrilled to begin working with such an experienced and well-respected firm, and look forward to benefiting from TA’s valuable insight and support.”

However, it can also be applied by

However, it can also be applied by  London, UK-based SaaS construction collaboration technology vendor

London, UK-based SaaS construction collaboration technology vendor

“When taking into consideration the cost of opening up new operations, I am particularly buoyed by the operating profit result of the business. This gives the Group great scope for growth to the top line going forward. Our cost base is now so well structured that almost all of our investment will be focused on Sales & Marketing and M&A activity.

“When taking into consideration the cost of opening up new operations, I am particularly buoyed by the operating profit result of the business. This gives the Group great scope for growth to the top line going forward. Our cost base is now so well structured that almost all of our investment will be focused on Sales & Marketing and M&A activity. It’s been an interesting couple of months for the Melbourne, Australia-based SaaS construction collaboration vendor

It’s been an interesting couple of months for the Melbourne, Australia-based SaaS construction collaboration vendor  “We will continue to invest in product, sales, marketing and customer service to capture the large global market opportunity. This investment will further consolidate our market leading position, underpinning our growth for years to come and enabling Aconex to deliver on its mission of connecting teams to build the world.”

“We will continue to invest in product, sales, marketing and customer service to capture the large global market opportunity. This investment will further consolidate our market leading position, underpinning our growth for years to come and enabling Aconex to deliver on its mission of connecting teams to build the world.”

According to an

According to an  Meanwhile, Leigh Jasper was visiting the UK. I met him in the former Conject offices in Woking (now with Aconex branding – the UK operation also has an office in central London, and the locations would eventually be rationalised he told me, though this won’t affect the development centre in Nottingham).

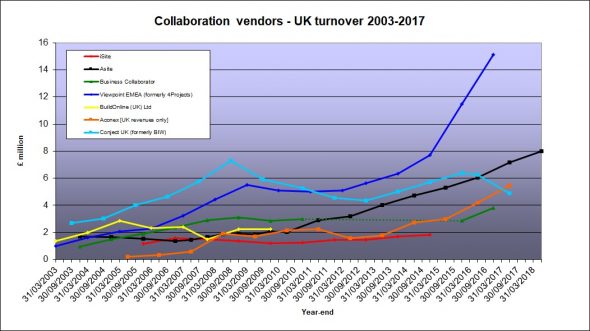

Meanwhile, Leigh Jasper was visiting the UK. I met him in the former Conject offices in Woking (now with Aconex branding – the UK operation also has an office in central London, and the locations would eventually be rationalised he told me, though this won’t affect the development centre in Nottingham). Conject’s merger with BIW was a prolonged process, with key developments in areas such as mobile technology and BIM delayed at a time when, particularly in the UK, rival vendors were investing heavily in research and development activities. As a result, Conject lagged behind SaaS collaboration competitors such as Viewpoint (formerly 4Projects), Aconex and Asite in adding mobile applications to its portfolio (buying France’s Wapp6 in

Conject’s merger with BIW was a prolonged process, with key developments in areas such as mobile technology and BIM delayed at a time when, particularly in the UK, rival vendors were investing heavily in research and development activities. As a result, Conject lagged behind SaaS collaboration competitors such as Viewpoint (formerly 4Projects), Aconex and Asite in adding mobile applications to its portfolio (buying France’s Wapp6 in  “As it’s part of the platform, in a sense everybody uses it, but obviously to varying degrees. Some companies will use it very heavily and put lots of models into the system. Others might use it at a more shallow level. But BIM is a critical part of what we do – it wasn’t going to be something that was optional. We are putting digital building blocks together enabling us to create a collaborative operating system for the construction industry, and BIM is part of that operating system, as is mobility, how we handle documentation, workflows, cost – all these interlink…. Everything needs to be able to link to everything else.”

“As it’s part of the platform, in a sense everybody uses it, but obviously to varying degrees. Some companies will use it very heavily and put lots of models into the system. Others might use it at a more shallow level. But BIM is a critical part of what we do – it wasn’t going to be something that was optional. We are putting digital building blocks together enabling us to create a collaborative operating system for the construction industry, and BIM is part of that operating system, as is mobility, how we handle documentation, workflows, cost – all these interlink…. Everything needs to be able to link to everything else.” By contrast, the functionality of Conject’s mobile tools would be retained: “We are pulling it all into one platform. Any functionality that we don’t have in Aconex Field we are pulling into our solution,” Jasper said. The company’s product development approach is not based on trying to cover every possible requirement: “We are not one for being a mile wide but an inch deep. If we are going to add a function or a module, we want to make sure it’s really good.”

By contrast, the functionality of Conject’s mobile tools would be retained: “We are pulling it all into one platform. Any functionality that we don’t have in Aconex Field we are pulling into our solution,” Jasper said. The company’s product development approach is not based on trying to cover every possible requirement: “We are not one for being a mile wide but an inch deep. If we are going to add a function or a module, we want to make sure it’s really good.”

The company has, understandably, attracted a lot of investor attention, being the first construction SaaS business to do an IPO. There was some uncertainty ahead of the

The company has, understandably, attracted a lot of investor attention, being the first construction SaaS business to do an IPO. There was some uncertainty ahead of the

Conventional capture of field data using paper-based systems and/or manual entry into Excel spreadsheets is still commonplace across many construction sites, but increased digitisation, including the adoption of BIM, is making professionals more conscious about the need to capture, record and reuse data consistently, both within projects and across a businesses’ projects.

Conventional capture of field data using paper-based systems and/or manual entry into Excel spreadsheets is still commonplace across many construction sites, but increased digitisation, including the adoption of BIM, is making professionals more conscious about the need to capture, record and reuse data consistently, both within projects and across a businesses’ projects.

CEMAR was founded by NEC contract expert and civil engineer Ben Walker (now CEO, right) and his father Andy (now retired); Ben’s brother, Dan, is CEMAR’s CIO (Ben and Dan Walker and Nick Woodrow are the business’s shareholders). The business was incorporated in 2005 and initially developed traditional on-premise software (formerly

CEMAR was founded by NEC contract expert and civil engineer Ben Walker (now CEO, right) and his father Andy (now retired); Ben’s brother, Dan, is CEMAR’s CIO (Ben and Dan Walker and Nick Woodrow are the business’s shareholders). The business was incorporated in 2005 and initially developed traditional on-premise software (formerly

My most visited post is from February 2013 (

My most visited post is from February 2013 ( The afore-mentioned

The afore-mentioned  If Viewpoint’s combination of ERP and collaboration proved an attractive proposition to Trimble, Germany’s

If Viewpoint’s combination of ERP and collaboration proved an attractive proposition to Trimble, Germany’s  Another UK-based vendor,

Another UK-based vendor,  A sister company of Belgium-based

A sister company of Belgium-based  Two days after

Two days after  For example, after Germany’s Conject brought UK-based BIW Technologies in

For example, after Germany’s Conject brought UK-based BIW Technologies in  And while we might expect there to be some rationalisation of overheads, the bigger challenge will be assimilating the two recent acquisitions, which both bring substantial customer and user bases (at yesterday’s London event, Viewpoint said it now had over 315,000 current active users of Viewpoint for Projects on almost 160,000 projects; e-Builder has supported over 200,000 projects), with the Trimble Connect applications. There will be scope for economies of scale in rationalising hosting and other infrastructure provision, and also – as Aconex did following its Conject acquisition – to identify and invest further in the highly valued functionalities of the different SaaS and mobile systems. By developing the ‘best of breed’ capabilities that will retain customer and end-user loyalty, Trimble might encourage them to migrate to enhanced new solutions.

And while we might expect there to be some rationalisation of overheads, the bigger challenge will be assimilating the two recent acquisitions, which both bring substantial customer and user bases (at yesterday’s London event, Viewpoint said it now had over 315,000 current active users of Viewpoint for Projects on almost 160,000 projects; e-Builder has supported over 200,000 projects), with the Trimble Connect applications. There will be scope for economies of scale in rationalising hosting and other infrastructure provision, and also – as Aconex did following its Conject acquisition – to identify and invest further in the highly valued functionalities of the different SaaS and mobile systems. By developing the ‘best of breed’ capabilities that will retain customer and end-user loyalty, Trimble might encourage them to migrate to enhanced new solutions.

In one part of the report (p.19), NBS usefully shows how awareness and adoption of BIM has changed since 2011. This is valuable trend data as NBS has largely deployed the same methodology to collect its data each year, so the composition of its (self-selecting) sample will be broadly the same each time. BIM advocates will be encouraged that adoption apparently continues to increase.

In one part of the report (p.19), NBS usefully shows how awareness and adoption of BIM has changed since 2011. This is valuable trend data as NBS has largely deployed the same methodology to collect its data each year, so the composition of its (self-selecting) sample will be broadly the same each time. BIM advocates will be encouraged that adoption apparently continues to increase.

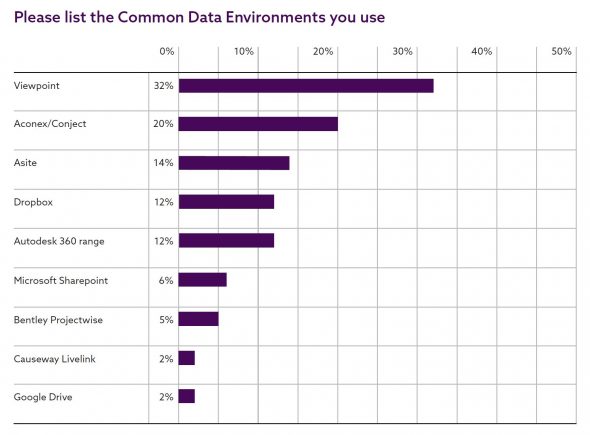

For the first time, NBS has undertaken a separate survey looking at the technologies. Recently published, the NBS Construction Technology Report 2019 (

For the first time, NBS has undertaken a separate survey looking at the technologies. Recently published, the NBS Construction Technology Report 2019 (

Pedantically, perhaps we should be talking more about ‘digitalisation‘: “the use of digital technologies to change a business model and provide new revenue and value-producing opportunities – the process of moving to a digital business” (to use Gartner’s definition). I have been speaking to audiences recently* about how businesses need to do more than just adopt new technologies – they need to take on the challenge posed in “Digital Built Britain” in

Pedantically, perhaps we should be talking more about ‘digitalisation‘: “the use of digital technologies to change a business model and provide new revenue and value-producing opportunities – the process of moving to a digital business” (to use Gartner’s definition). I have been speaking to audiences recently* about how businesses need to do more than just adopt new technologies – they need to take on the challenge posed in “Digital Built Britain” in