CDEs? As BIM standards begin to emerge, do we also need some data exchange standards to support connected rather than common data environments?

Concerted efforts to mobilise the UK built environment industry to adopt building information modelling (BIM) began around 10 years ago, but there is still some distance to go. Anecdotal industry feedback, plus data from nine annual NBS BIM surveys (the 10th, the 2020 edition, has just been launched, by the way) and other reports, suggests UK BIM adoption spans a wide continuum.

Some clients, contractors and consultants now demand BIM from all their contract partners and suppliers. Other firms are in the process of BIM adoption. But there is still a large group of late adopters and laggards for whom BIM is still unfamiliar, even unknown, and they persist largely with conventional 2D and paper-type processes supported by email and spreadsheets. As an illustration (and indicator of BIM adoption), the 2018 NBS annual BIM survey looked at adoption of ‘common data environment’ (CDE) platforms by UK-based construction businesses: the data ranged from 21% of firms using a CDE for all projects, to 28% not using any CDE at all.

![NBS 2018 Report: CDE sharing]()

Shifts in construction away from paper-based working towards electronic collaboration have been under way since the late 1990s. Construction collaboration technology providers rose to prominence during the dot.com boom at the turn of the century, and as web-based Software-as-a-Service ‘extranet’ platforms become widely used across most major projects, it was perhaps inevitable that they would be seen as part of the foundation for BIM-based working.

It has been almost seven years since the CDE phrase and abbreviation first began to be used in connection with BIM – following the publication of UK guidance in PAS 1192 part 2 in February 2013 (read more in this October 2013 Extranet Evolution post: Thinking about BIM, SaaS and the Common Data Environment). The 2013 definition of a CDE was somewhat vague, envisaging several possible combinations of technologies, but some of the former ‘extranet’ vendors soon began to use the term for marketing, incorporating it into their product branding or product descriptions, and claiming their solutions would help project teams comply with the April 2016 UK government ‘Level 2’ BIM mandate.

International BIM standardisation

Since 2013, the BIM process and its supporting sets of documents, protocols and draft standards has gradually been developed and made more international. Based on the PAS 1192 suite, the first draft parts of ISO 19650 were issued for consultation in 2017, and the first two parts (ISO 19650-1: BIM concepts and priniciples, ISO 19650-2: BIM Delivery phase of assets) were published in late 2018.

(Two further parts are expected to be published in 2020: ISO 19650-3 Operational phase of assets, and ISO 19650-5: Security-minded approach to information management.)

![UK BIM Framework guidance 2, 2nd ed, cover]() In the meantime, the government-appointed UK BIM Task Group was eventually disbanded and UK BIM efforts are now being led by three main organisations: BSI, the Cambridge-based Centre for Digital Built Britain, and the UK BIM Alliance.* Closely involved with the international BIM standardisation movement, these bodies have helped develop UK-specific guidance to aid interpretation and adoption of the ISO 19650 standards – there is a UK national foreword to ISO 19650-1 and a UK national annex to ISO 19650-2, while guidance documents relating to both parts have also been produced and are now updated on a quarterly basis. These form part of the UK BIM Framework launched in October 2019.

In the meantime, the government-appointed UK BIM Task Group was eventually disbanded and UK BIM efforts are now being led by three main organisations: BSI, the Cambridge-based Centre for Digital Built Britain, and the UK BIM Alliance.* Closely involved with the international BIM standardisation movement, these bodies have helped develop UK-specific guidance to aid interpretation and adoption of the ISO 19650 standards – there is a UK national foreword to ISO 19650-1 and a UK national annex to ISO 19650-2, while guidance documents relating to both parts have also been produced and are now updated on a quarterly basis. These form part of the UK BIM Framework launched in October 2019.

This “overarching approach to implementing BIM in the UK” supersedes previous industry guidance and the notion of BIM Levels. The guidance documents – particularly the Part 2: Processes for Project Delivery – identify key activities and outputs for all parties involved in a project (client, consultants, contractors, specialists, etc), and describe what should be documented in appointments/contracts (in terms of information activities/deliverables) and what clauses within ISO 19650-2 are particularly relevant to each party. The 2nd edition, published in October 2019, also includes some 16 pages of detailed guidance about common data environments, written by Galliford Try’s John Ford.

Towards a common approach to CDE metadata

![CDE guidance based on ISO 19650-1 fig 10]() Importantly, Ford’s guidance highlights (p.24) that, despite some vendors’ branding and marketing assertions, “the CDE is a combination of technical solutions and process workflows (later stressing “it is fundamental that workflows are developed first and solutions are selected to facilitate the workflow”). Ford notes different technologies may be involved – indeed, the CDE may comprise a combination of technologies: “document management tools for design files, contract management tools that manage commercial information, email management tools for correspondences and mobile based tools for site quality data.” He continues: “Each solution may have multiple and different workflows ensuring that information is carefully planned, shared, stored, managed and retrieved and that it is timely, correct, complete, and consistent.”

Importantly, Ford’s guidance highlights (p.24) that, despite some vendors’ branding and marketing assertions, “the CDE is a combination of technical solutions and process workflows (later stressing “it is fundamental that workflows are developed first and solutions are selected to facilitate the workflow”). Ford notes different technologies may be involved – indeed, the CDE may comprise a combination of technologies: “document management tools for design files, contract management tools that manage commercial information, email management tools for correspondences and mobile based tools for site quality data.” He continues: “Each solution may have multiple and different workflows ensuring that information is carefully planned, shared, stored, managed and retrieved and that it is timely, correct, complete, and consistent.”

Project delivery may also involve more than one ‘CDE’. As well as the ISO 19650-2 defined “project CDE”, delivery teams may implement their own additional CDEs “which can introduce complexities into the management of information” (I have talked to project managers where, for example, different vendors’ ‘CDEs’ are being used by the client, by a contractor, and by designers). Moreover, different CDE solutions “offer varying degrees of metadata assignment” (metadata is “data that describes and gives information about other data”), but “there isn’t currently … a standard exchange protocol adopted by our industry” (p.27), complicating how information and its metadata can be transferred from one system to another – a step which, Ford suggests, is often achieved by a “manual” workaround, though I am also aware of API-type solutions such as John Egan’s interesting BIMLauncher project.

(‘Extranet’ exchange protocols were once the subject of detailed conversations within the Network of Construction Collaboration Technology Vendors during the mid 2000s, when I was at BIW Technologies. Today in Europe, Germany in particular, a standard to promote open data exchange between CDEs – DIN SPEC 91931-1 – is being developed with input from vendors including thinkproject, Oracle – through people from its Germany’s Aconex [Conject] acquisition – and Nemetschek’s AllPlan.)

Against this background, the metadata subject was raised at a meeting (the first I chaired) of the UK BIM Alliance’s Technology Group on 26 November 2019. It was pointed out that “whole-life” audit trails defining the post-Grenfell “Golden Thread” of data about built assets, their components and systems might be compromised if that data and associated metadata could not be reliably exchanged between CDEs, particularly once information ceased to be managed by contractors and designers and became part of owners’ responsibilities. The envisaged future is also about connecting ‘Digital Twins’ throughout their operational whole life.

The Technology Group will be returning to the subject at a meeting on 5 February 2020, while the topic may also be covered in a UK BIM Alliance Technology Group panel discussion at BIMShowLive in Newcastle on Thursday 27 February 2020 (so I would clearly welcome any observations from Extranet Evolution readers).

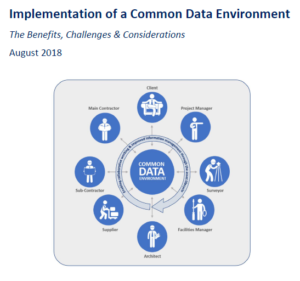

![SFT CDE implemention guide]() Related Technology Group conversations also covered other UK CDE guidance, notably a guide Implementation of a Common Data Environment (PDF), produced for the Scottish Futures Trust by AECOM and published in August 2018 – so predating the ISO 19650 Parts 1 and 2, and the UK guidance. Another document, from the CDE sub group of the UK Government BIM Working Group and entitled Asset Information Management – Common Data Environment: Functional Requirements (PDF), also predates the ISO standards, etc, having been published in February 2018. (This may also need to be reviewed once ISO 19650-3 covering asset operations is published later in 2020, while its observations on storage and cyber security could well also be updated once ISO 19650-5 is published).

Related Technology Group conversations also covered other UK CDE guidance, notably a guide Implementation of a Common Data Environment (PDF), produced for the Scottish Futures Trust by AECOM and published in August 2018 – so predating the ISO 19650 Parts 1 and 2, and the UK guidance. Another document, from the CDE sub group of the UK Government BIM Working Group and entitled Asset Information Management – Common Data Environment: Functional Requirements (PDF), also predates the ISO standards, etc, having been published in February 2018. (This may also need to be reviewed once ISO 19650-3 covering asset operations is published later in 2020, while its observations on storage and cyber security could well also be updated once ISO 19650-5 is published).

So, we are at an interesting point in the development of BIM and of CDEs. To date, much of the standardisation work has focused on processes and information deliverables – often files. While (naturally) vendors might prefer users to rely on a single CDE or vendor silo solution, perhaps we are now reaching the point where vendors need to be thinking less about single common data environments and more about connected data environments?

(* Disclosure: This blog post was written partly in my role, since July 2019, as a member of the UK BIM Alliance executive team and more recently as chair of its Technology Group, who’s members include several vendors of CDE technologies. The views are mine alone.)

AEC software-as-a-Service pioneer Colin Smith has been appointed to the board of the Vienna, Austria-based SaaS vendor PlanRadar. The web-based application provides construction documentation, defect and task management capabilities and is now expanding internationally, opening a UK office in London.

AEC software-as-a-Service pioneer Colin Smith has been appointed to the board of the Vienna, Austria-based SaaS vendor PlanRadar. The web-based application provides construction documentation, defect and task management capabilities and is now expanding internationally, opening a UK office in London. The PlanRadar platform works on smartphone and tablet (iOS, Android and Windows) and allows construction workers to automate the entire documentation process with interactive blueprints and floorplans, claiming to save an average of seven working hours per week in admin time and averting errors. The company says over 3,500 customers already use PlanRadar worldwide to manage construction projects and real estate processes. In the last 12 months, PlanRadar says it has increased sales by 300 per cent and expanded its workforce to 57 employees.

The PlanRadar platform works on smartphone and tablet (iOS, Android and Windows) and allows construction workers to automate the entire documentation process with interactive blueprints and floorplans, claiming to save an average of seven working hours per week in admin time and averting errors. The company says over 3,500 customers already use PlanRadar worldwide to manage construction projects and real estate processes. In the last 12 months, PlanRadar says it has increased sales by 300 per cent and expanded its workforce to 57 employees. “Risks around bottlenecks in the supply of construction materials and tradespeople can be mitigated with platforms like PlanRadar; digitised processes can raise their efficiency potential against the competition, improve quality control and deliver 900 per cent ROI. In light of our rapid growth in the past year and the positive international business outlook for 2019, we have moved our head office to a much larger facility in central Vienna to support the increased demand.”

“Risks around bottlenecks in the supply of construction materials and tradespeople can be mitigated with platforms like PlanRadar; digitised processes can raise their efficiency potential against the competition, improve quality control and deliver 900 per cent ROI. In light of our rapid growth in the past year and the positive international business outlook for 2019, we have moved our head office to a much larger facility in central Vienna to support the increased demand.” “There’s a lot of interest in ConTech right now, but it doesn’t just mean modular housing and 3D printing. It means simple but effective innovation across the entire supply-chain. PlanRadar has developed an intuitive platform that has revolutionised how Europe manages the documentation and communication process of the asset lifecycle. Now it’s time for the UK to benefit”

“There’s a lot of interest in ConTech right now, but it doesn’t just mean modular housing and 3D printing. It means simple but effective innovation across the entire supply-chain. PlanRadar has developed an intuitive platform that has revolutionised how Europe manages the documentation and communication process of the asset lifecycle. Now it’s time for the UK to benefit”

UK-based sales director Steve Cooper, left, and colleague Duncan Kneller (who were both part of the BIW Technologies business back in 2000, before it was acquired by Conject in 2010, and before it was in turn acquired by Aconex in 2016),* are now part of the Aconex product team at Oracle – Cooper is VP of Europe while Kneller is sales director, UK & Ireland; another veteran BIW/Conject consultant, Nick Sansome, is EMEA practice director, professional services. The above-mentioned Frank Weiss is another veteran of the business, a co-founder of Conject.

UK-based sales director Steve Cooper, left, and colleague Duncan Kneller (who were both part of the BIW Technologies business back in 2000, before it was acquired by Conject in 2010, and before it was in turn acquired by Aconex in 2016),* are now part of the Aconex product team at Oracle – Cooper is VP of Europe while Kneller is sales director, UK & Ireland; another veteran BIW/Conject consultant, Nick Sansome, is EMEA practice director, professional services. The above-mentioned Frank Weiss is another veteran of the business, a co-founder of Conject.

In the meantime, the government-appointed UK BIM Task Group was eventually disbanded and UK BIM efforts are now being led by three main organisations:

In the meantime, the government-appointed UK BIM Task Group was eventually disbanded and UK BIM efforts are now being led by three main organisations:  Importantly, Ford’s guidance highlights (p.24) that, despite some vendors’ branding and marketing assertions, “the CDE is a combination of technical solutions and process workflows (later stressing “it is fundamental that workflows are developed first and solutions are selected to facilitate the workflow”). Ford notes different technologies may be involved – indeed, the CDE may comprise a combination of technologies: “document management tools for design files, contract management tools that manage commercial information, email management tools for correspondences and mobile based tools for site quality data.” He continues: “Each solution may have multiple and different workflows ensuring that information is carefully planned, shared, stored, managed and retrieved and that it is timely, correct, complete, and consistent.”

Importantly, Ford’s guidance highlights (p.24) that, despite some vendors’ branding and marketing assertions, “the CDE is a combination of technical solutions and process workflows (later stressing “it is fundamental that workflows are developed first and solutions are selected to facilitate the workflow”). Ford notes different technologies may be involved – indeed, the CDE may comprise a combination of technologies: “document management tools for design files, contract management tools that manage commercial information, email management tools for correspondences and mobile based tools for site quality data.” He continues: “Each solution may have multiple and different workflows ensuring that information is carefully planned, shared, stored, managed and retrieved and that it is timely, correct, complete, and consistent.” Related Technology Group conversations also covered other UK CDE guidance, notably a guide Implementation of a Common Data Environment (

Related Technology Group conversations also covered other UK CDE guidance, notably a guide Implementation of a Common Data Environment ( With its

With its  According to an

According to an  Meanwhile, Leigh Jasper was visiting the UK. I met him in the former Conject offices in Woking (now with Aconex branding – the UK operation also has an office in central London, and the locations would eventually be rationalised he told me, though this won’t affect the development centre in Nottingham).

Meanwhile, Leigh Jasper was visiting the UK. I met him in the former Conject offices in Woking (now with Aconex branding – the UK operation also has an office in central London, and the locations would eventually be rationalised he told me, though this won’t affect the development centre in Nottingham). “We are seeing really big interest, and a number of deals have already been done on the product. [American carmaker and energy storage company] Tesla is now a customer of ours and is one we wouldn’t have got without Connected Cost, so it’s helping us win more work, and it’s really important to our customers. Particularly in the US, cost is more important to them than collaboration, and I think our cost product is the best SaaS solution on the market, particularly when you compare it to some of the products built 10 or 15 years ago.”

“We are seeing really big interest, and a number of deals have already been done on the product. [American carmaker and energy storage company] Tesla is now a customer of ours and is one we wouldn’t have got without Connected Cost, so it’s helping us win more work, and it’s really important to our customers. Particularly in the US, cost is more important to them than collaboration, and I think our cost product is the best SaaS solution on the market, particularly when you compare it to some of the products built 10 or 15 years ago.” Conject’s merger with BIW was a prolonged process, with key developments in areas such as mobile technology and BIM delayed at a time when, particularly in the UK, rival vendors were investing heavily in research and development activities. As a result, Conject lagged behind SaaS collaboration competitors such as Viewpoint (formerly 4Projects), Aconex and Asite in adding mobile applications to its portfolio (buying France’s Wapp6 in

Conject’s merger with BIW was a prolonged process, with key developments in areas such as mobile technology and BIM delayed at a time when, particularly in the UK, rival vendors were investing heavily in research and development activities. As a result, Conject lagged behind SaaS collaboration competitors such as Viewpoint (formerly 4Projects), Aconex and Asite in adding mobile applications to its portfolio (buying France’s Wapp6 in  “As it’s part of the platform, in a sense everybody uses it, but obviously to varying degrees. Some companies will use it very heavily and put lots of models into the system. Others might use it at a more shallow level. But BIM is a critical part of what we do – it wasn’t going to be something that was optional. We are putting digital building blocks together enabling us to create a collaborative operating system for the construction industry, and BIM is part of that operating system, as is mobility, how we handle documentation, workflows, cost – all these interlink…. Everything needs to be able to link to everything else.”

“As it’s part of the platform, in a sense everybody uses it, but obviously to varying degrees. Some companies will use it very heavily and put lots of models into the system. Others might use it at a more shallow level. But BIM is a critical part of what we do – it wasn’t going to be something that was optional. We are putting digital building blocks together enabling us to create a collaborative operating system for the construction industry, and BIM is part of that operating system, as is mobility, how we handle documentation, workflows, cost – all these interlink…. Everything needs to be able to link to everything else.” By contrast, the functionality of Conject’s mobile tools would be retained: “We are pulling it all into one platform. Any functionality that we don’t have in Aconex Field we are pulling into our solution,” Jasper said. The company’s product development approach is not based on trying to cover every possible requirement: “We are not one for being a mile wide but an inch deep. If we are going to add a function or a module, we want to make sure it’s really good.”

By contrast, the functionality of Conject’s mobile tools would be retained: “We are pulling it all into one platform. Any functionality that we don’t have in Aconex Field we are pulling into our solution,” Jasper said. The company’s product development approach is not based on trying to cover every possible requirement: “We are not one for being a mile wide but an inch deep. If we are going to add a function or a module, we want to make sure it’s really good.”

The company has, understandably, attracted a lot of investor attention, being the first construction SaaS business to do an IPO. There was some uncertainty ahead of the

The company has, understandably, attracted a lot of investor attention, being the first construction SaaS business to do an IPO. There was some uncertainty ahead of the

Conventional capture of field data using paper-based systems and/or manual entry into Excel spreadsheets is still commonplace across many construction sites, but increased digitisation, including the adoption of BIM, is making professionals more conscious about the need to capture, record and reuse data consistently, both within projects and across a businesses’ projects.

Conventional capture of field data using paper-based systems and/or manual entry into Excel spreadsheets is still commonplace across many construction sites, but increased digitisation, including the adoption of BIM, is making professionals more conscious about the need to capture, record and reuse data consistently, both within projects and across a businesses’ projects.

CEMAR was founded by NEC contract expert and civil engineer Ben Walker (now CEO, right) and his father Andy (now retired); Ben’s brother, Dan, is CEMAR’s CIO (Ben and Dan Walker and Nick Woodrow are the business’s shareholders). The business was incorporated in 2005 and initially developed traditional on-premise software (formerly

CEMAR was founded by NEC contract expert and civil engineer Ben Walker (now CEO, right) and his father Andy (now retired); Ben’s brother, Dan, is CEMAR’s CIO (Ben and Dan Walker and Nick Woodrow are the business’s shareholders). The business was incorporated in 2005 and initially developed traditional on-premise software (formerly

My most visited post is from February 2013 (

My most visited post is from February 2013 (

One of the key figures in this recent shift is Franck Meudec, right, the founder of Wapp6,

One of the key figures in this recent shift is Franck Meudec, right, the founder of Wapp6,